- Credicorp published the fourth edition of its Financial Inclusion Index (FII), a study that analyzes citizens’ relationship with the financial system in eight countries in the region.

- On a scale from 0 to 100, where higher scores indicate better levels of financial inclusion, Latin America’s level rose from 38 points in 2021 to 47.6 in 2024.

August 2024. Credicorp, a leading financial service holding in Peru, launched its fourth edition of the Financial Inclusion Index, a study that revealed that 28% of the adult population in Latin America reached the achieved (advanced) level of financial inclusion, which represented a considerable increase compared to the 25% reported in 2023 and the 16% registered in 2021. The results reflect a positive trend in the region, which has been in play for four consecutive years.

The study, which is developed annually by Credicorp, collects data from eight countries in Latin America: Argentina, Bolivia, Chile, Colombia, Ecuador, Mexico, Panama and Peru. Ipsos is responsible for compiling this information.

The index is built with three dimensions of measurement: access, use and perceived quality of the financial system. It focuses on demand, given that it compiles information directly from citizens through household surveys. Fieldwork was conducted between April and May 2024 and more than 13,000 people participated.

Overall results

On a scale from 0 to 100 where higher squares mean higher levels of financial inclusion, Latin America has risen from 38.2 points in 2021 to 47.6 points in 2024. Scores by country were as follows:

- Chile | 58.3

- Panamá | 56

- Argentina | 54.4

- Ecuador | 53.2

- Colombia | 48.3

- Perú | 46.1

- Bolivia | 43.7

- México | 42.6

Access Dimension

In the Access dimension, the region’s level has risen 17 points since 2021, going from 33 to 50 in 2024. Argentina ranks first, followed by Panama and Chile. By analyzing access to financial products and services, the study concludes that although digital channels are preferred by many, a considerably substantial number of the population still depends on physical channels (bank branches, ATMs, etc.) for their financial needs.

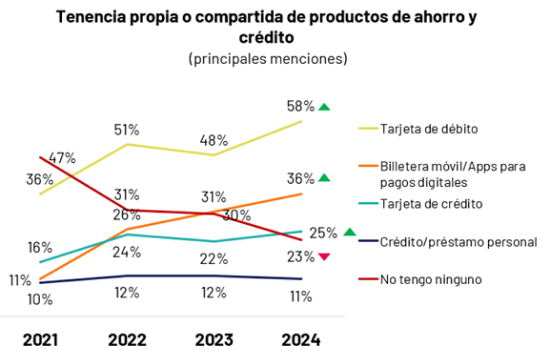

An increase was registered in the number of people that conduct transactions through physical channels such as ATMs, correspondents and branches. Finally, growth in possession of digital wallets was noteworthy, placing this product second -behind debit cards- among the most popular financial tools.

Use and perceived quality

In terms of the Use dimension, and despite progress on the digital-payment end, cash (96%) continues to dominate as the most used payment method, followed by debit cards (34%) and mobile wallets (18%).

Chile is in first place, followed by Argentina and Panama. The use of debit cards to pay for products and services stands out in Chile, and the level of this use is equal to that of cash use. It is important to note that both Chile and Mexico are the only countries where the just of mobile wallets in below 10%. On the contrary, in Peru and Colombia reported elevated levels of use of mobile wallets (Yape, Daviplata, among others) but registered a lag in the use of other digital channels.

At the Latin American level, in terms of where income is received, an increase was reported in the proportion of citizens that say they receive funds in personal accounts (55%). This growth is reflected in the low level of cash use (16%).

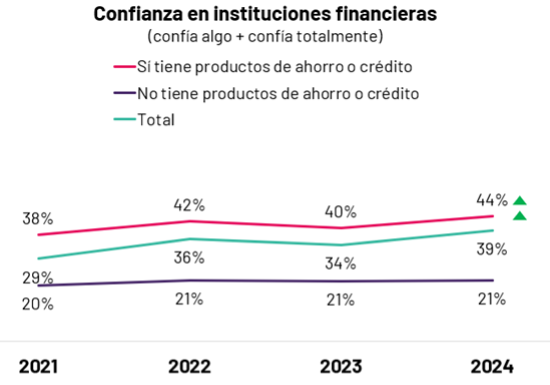

In the case of the Perceived Quality dimension, Ecuador, Panama and Colombia ranked first, second and third respectively. It is important to note that at the regional level, trust in financial institutions has grown nearly 10 percentage points since 2021, going from 29% to 39% in 2024. The fact that trust in the financial system and the positive valuation of banking and mobile wallets are promising signs. Regardless, the perception of insecurity among users highlights the importance of strengthening trust and education in the framework of digital transformation in the sector.

Digital means

The adoption and use of digital means has increased, where the use of mobile wallets ranks highest. As the study shows, 62% of Latin Americans use these applications frequently to make payments or purchases. Argentina (65%), Panama (63%), Colombia (62%) and Peru (58%) stand out in terms of adoption of mobile wallets and payment applications, and in some cases, use of these channels outpaces the use of debit cards. In terms of satisfaction, Argentina (78%) and Colombia (67%) are the countries where digital means of people are best perceived. Nevertheless, at the regional level, fears of conducting transactions through digital means persists, both among users of savings and credit products (37%) and non-users (38%).

Nevertheless, despite advances in different indicators, gaps in financial inclusion persist and primarily affect women, people over 60, inhabitants of rural areas, individuals with no access to internet, and those with lower education levels. This trend was seen in the eight countries measured and in each of FII’s editions.

You can find the complete report at: https://grupocredicorp.com/indice-inclusion-financiera