- For the first time, Credicorp published a sub-study of its Financial Inclusion Index (FII). This research examined the gaps between formal and informal employees at the financial inclusion level in 8 countries in the region.

- According to the study, while 42% of formal workers are at the “achieved” level (advanced) of financial inclusion, only 18% of informal workers registered this level.

Lima, July 2024.- Credicorp, the leading financial service holding in the country, presented its first study on Informality and Financial Inclusion in Latin America, which was conducted in eight countries in the region. This document analyzes the gaps in financial inclusion between informal and formal employees in eight countries in Latin America: Peru, Colombia, Bolivia, Chile, Ecuador, Mexico, Panama and Argentina. The results underline the inversely proportional relation between a country’s rate of job informality and its level of financial inclusion: higher levels of informality meant lower levels of financial inclusion and vice versa. This suggests that improving access to financial services could contribute to formalizing employment in the region.

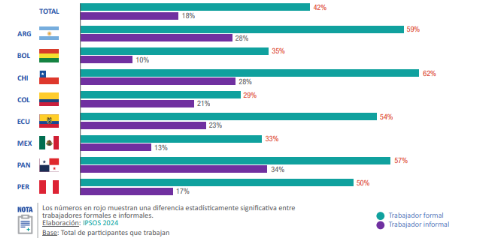

According to the study, only 18% of informal employees had reached an “achieved” (advanced) level of financial inclusion, versus 42% of formal employees. If these results are disaggregated by dimensions of access, use and perceived quality of financial products and services, the level of formal employees far outpaces that of their informal counterparts. Argentina, Chile and Panama have the highest proportion of informal employees at the “achieved” (advanced) level of financial inclusion:

Citizens at the “achieved” level in the FII according to formality and country.

According to the study, the largest gaps between informal and formal workers at the achieved level of financial inclusion were found for Chile (34 percentage points of difference), Peru (33 points), Argentina (31 percentage points) and Ecuador (31 points); nonetheless, when analyzing these results, it is important to remember that these countries have varying percentages of informal employees. In Peru’s case, where more than two thirds of the citizens work informally, only 17% have reached the achieved (advanced ) level of financial inclusion.

Possession of products in the financial system

At the regional level, informal employees have fewer savings, insurance and credit products than their formal counterparts. Thirty (30%) of informal employees have no savings or insurance products; 7% of formal workers reported having neither. Twenty-eight percent (28%) of informal employees have at least one credit product, compared to 51% of formal employees. Panama (41%), Bolivia (39%) and Ecuador (36%) stand out for registering the highest percentage of informal workers with credit products in comparison to the regional average (28%). A higher percentage of informal employees (8%) have business loans than formal employees (5%).

The analysis by country shows particularities in terms of possession of savings products. In Chile (85%), Argentina (78%), Colombia (78%), Ecuador (74%) and Panama (73%), the proportion of informal employees that possesses savings products is above the regional average (58%). For example, 80% of informal employees in Chile have a debit card while a significant percentage of informal employees use mobile wallets in Argentina (61%) and Colombia (65%). En Ecuador, 64% possess savings or current accounts. These numbers show the variability in access to financial products between different countries.

Possession of insurance products also reflects disparities, given that only half (50%) of informal employees have at least one product in this line versus 76% of formal employees. The largest gaps were found in possession of life insurance (22% vs 7%), car insurance (21% vs 8%) and private health insurance (19% vs 6%), which suggests that informal employees are less protected against risk.

Use of products and services in the financial system

Informal employees depend more on cash to receive wages. Thirty (30%) of informal employees only receive cash compared to 8% of formal employees. While 37% of informal employees receive income through bank transfers or mobile wallets, 75% of formal employees receive wages through these channels. Colombia is an exception, given that cash payments to formal employees and informal employees registered a fairly similar level (15% vs 18%).

In terms of savings, a larger percentage of informal workers (16%) save outside of the financial system, meaning at home or by turning income over to a relative, compared to formal employees (12%). This gap also reflects possession of debit cards, where 68% of formal employees possess a card, compared to a much lower percentage of informal employees (39%). In Chile, Ecuador and Panama, the percentage of informal employees who save outside the financial system tops the regional average (12%), standing at 17%, 23% and 29% respectively. Mobile wallets have become the preferred method of savings among informal employees in Colombia (65%) and Argentina (61%).

The results of the sub-study suggest that facilitating access to financial services can help formalize the economy in the region. The analysis of gaps in financial inclusion contributes to efforts to build effective public policies that consider the particularities of each country. In the future, it will be necessary to research the factors that drive employees and companies to remain informal and design formalization strategies that adapt to each context.

This study is part of the Credicorp’s Financial Inclusion Index, which can be downloaded at www.grupocredicorp.com/indice-inclusion-financiera