We are a leading financial services holding in Peru, where Credicorp has operated for more than 135 years.

We contribute to improving lives, accelerating the changes that our countries need

Who are we?

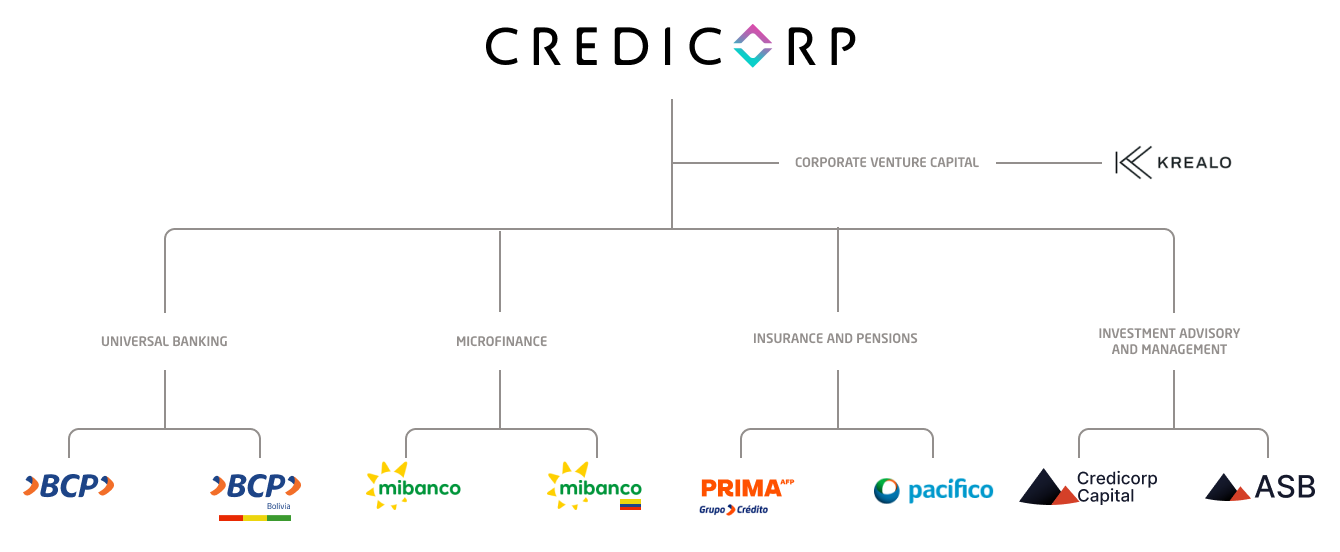

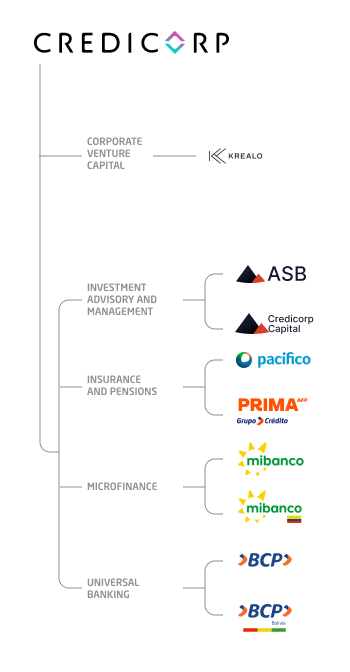

Credicorp is organized into four lines of business: (1) Universal Banking, (2) Insurance and Pensions (3) Microfinance (4) Investment Banking and Wealth Management. Additionally, the Group operates a Corporate Venture Capital Operation, Krealo.

Our purpose, vision and values guide us as we create value for our stakeholders and the societies of countries in which we operate.

Our regional presence

As we serve our Peruvian clients’ universal banking, insurance and pension, microfinance, investment banking and wealth management needs, we are shoring up our presence in and solutions for regional markets.

EE.UU

Panamá

Colombia

Perú

Bolivia

Chile

Our Lines of Business

Credicorp has four lines of business and a Corporate Venture Capital operation.

- Universal Banking

- Microfinance

- Insurance and Pensions

- Investment Advisory and Management

- Corporate Venture Capital

We have a significant presence in Peru, where we lead the markets for loans and deposits. We also have a banking office in the United States (Miami) and a branch in Panama.

We are situated sixth in the Bolivian financial system in terms of loans and deposits.

We are leaders in the financial sector in Peru and Latin America and are currently the second largest microfinance entity in terms of total assets.

In the Colombian microfinance system, we are currently ranked fourth and sixth in the loans and deposit markets respectively.

We operate in the insurance market in Peru and are the second largest player in terms of written premiums. We participate in the market through three business units: P & C Insurance, Life Insurance, and EPS and Medical Assistance.

We manage pension funds in Peru, where we are currently ranked second for total funds under management. Our focus is on improving profitability.

We have operations in Chile, Peru, Colombia, Panama and the United States. This has allowed us to consolidate our leadership in the regional market, where we operate through four business units: Asset Management, Wealth Management, Capital Markets and Fiduciary Businesses.

We are present in Chile, Colombia and Peru and focus on external innovation to invest in opportunities that complement Credicorp’s current and future business lines as we strive to create financial and strategic value.

Vision and pillars

For many years, Credicorp’s subsidiaries have actively participated in the societies and economies in which they operate.

Notwithstanding, our focus on sustainability today is far more encompassing, and Environmental, Social and Corporate Governance initiatives (ESG) are now incorporated in the organization’s business strategies and activities.

Visión

To be a sustainable leader in the financial services industry in Latin American, guided by a larger purpose, focused on the future and intent on creating superior value for our employees, clients, shareholders and countries in which we operate.

Pillars

The sustainability program defines three pillars that will guide Credicorp’s sustainability goals from 2022 to 2025.

Create a more sustainable and inclusive economy

Improve citizens’ financial health

Empower our people to thrive

Purpose and Values

Our purpose reflects our commitment to improving lives by assuming an initiative-taking role in driving the changes that the communities in our area of operations need. To accomplish this, sustainability is a key component in our strategy as we strive to remain competitive in the long-term.

Purpose

“Contribute to improving lives, accelerating the changes that our countries need”.

Our reason to guide the decisions and actions of each of our businesses.

Valores

Respect

We have an open-door culture that respects and values people, their beliefs and decisions; we always promote a participative, collaborative and horizontal work environment.

Equity

We act fairly and equitably in how we recognize and treat people. We strive to ensure equal rights, responsibilities and opportunities for all.

Honesty

At Credicorp, we strive to be transparent and see to ensure that our actions are aligned with our beliefs and what we profess; we know that this is the only way to generate trust-based relations.

Sustainability

Because people are at the center of everything we do, we carefully attend to their needs, striving to ensure their social, economic and environmental wellbeing both today and tomorrow.

GenÉTICA Credicorp

This is a way of being and acting ethically that makes all the people who give life to this Group unique. We are driven not only to do things well, but to take them to the next level to achieve a positive impact on our environment and society.

Our GenÉTICA is reflected in our Code of Ethics, which is the primary guide in our quest to make the right decisions to build trust-based relations with all our stakeholders.

For more information on Compliance and Ethics click here

Credicorp’s History

Credicorp was created through the merger of three independent companies that, at the time of the holding’s origination, shared a common base of shareholders and clients: BCP, Atlantic Security Bank and Pacífico. These companies were represented on the New York Stock exchange under the ticker “BAP” (for the first letter of each subsidiary).

The Group was formed in 1995, following the acquisition of a majority stake in common shares of Banco de Crédito del Perú (BCP), Atlantic Security Holding Corporation (ASHC) and Pacífico Compañía de Seguros y Reaseguros S.A. (PPS). In the Exchange Offer of October 1995, Credicorp acquired 90.1% of the shares of BCP, 98.2% of the shares of ASHC and 75.8% of PPS. The common shares were listed on the Lima Stock Exchange (BVL). On March 19, 1996, Credicorp acquired the remaining 1.8% of ASHC’s circulating shares through an Exchange Offer that contemplated conditions like those set forth in the October 1995 offer.

Credicorp’s History

1995

2005

2021

Growth

(1995 - 2021)

Assets

11.8

34.7

244.8

20 times

Loans

7

15.7

147.6

20 times

Deposits

8.5

22.3

150.3

17 times

Equity

1.3

4.1

26.5

19 times

Market Cap (in dollars)

1.1

1.8

9.5

8 times

Net income

0.2

0.7

3.6

17 times

NII

0.6

1.5

9.4

15 times

Chronological History

More than 130 years of experience in the financial sector.

1889

BCP begins operations under the name Banco Italiano.

1995

Credicorp Ltd. sets up as a holding comprised of BCP, Grupo Pacífico, and Atlantic Security Bank.

2002

Purchases Banco Santander Central Hispano Perú (BSCHP) and subsequent merger by absorption in March 2003.

2005

In 2005, Credicorp Ltd. expanded into the pension business by founding Prima AFP, which began operations in August of the same year.

2009

In October 2009, BCP acquired CARE – Perú and all the shares that this entity held in Edyficar, which represented 77% of its share capital.

2010

Credicorp Ltd. acquired Alico’s shares in Pacífico Seguros y Pacífico Vida. Consequently, Credicorp Ltd. possessed 98% of Pacífico Seguros and jointly controlled 100% of Pacífico Vida.

2012

As part of its strategi plan, Credicorp Ltd. began creating a regional platform for investment banking. It acquired 51% of Correval S.A., a brokerage entity in Bogotá, Colombia. In July, it acquired a 61% share in Inversiones IM Trust S.A. in Chile.

2013

In April 2013, a company was set up in Peru to manage our investment banking operations in this country. The resulting company, Credicorp Capital, consolidated our regional platform for investment banking.

2014

Credicorp Ltd., through its subsidiary Edyficar, acquired a 61% share of Mibanco. At the end of the year, these microfinance companies merged.

2015

Grupo Pacífico signed an agreement with Banmédica to participate as equal partners in the health insurance and medical services businesses.

2017

The merger of PPS y Pacífico Vida was approved, through with PPS transferred all of its capital to Pacífico Vida. This merger went into effect on August 1, 2017.

2018

Credicorp Ltd. reorganized into four business lines:

- Universal Banking

- Microfinance

- Insurance and Pensions

- Investment Banking and Asset Management

2019

In January, 91% of Culqi was acquired and Krealo was registered. In March, Tyba was incorporated; in July Tenpo and Multicaja were acquired; in September, 85% of the Fondo de Inversión Independencia II was acquired; in November, Ultraserfinco S.A. was acquired; and in December, 77% of Banco Compartir S.A. was acquired.

2020

In June, a merger by absorption took place between Credicorp Capital Colombia S.A. and Ultraserfinco S.A., which led to the extinction of the latter. In October, a merger by absorption was conducted between Banco Compartir S.A. and Encumbra, and Mibanco Colombia was formed.

2021

In February, the final merger between Credicorp Capital Securities and Ultralat Capital Markets was completed, resulting in Credicorp Capital LLC. In August, the merger by absorption between Atlantic Security Bank (Cayman Islands) and ASB Bank Corp (Panama) was completed, with the latter being the last surviving entity.

2022

In March, Credicorp Capital Ltd. incorporated CC Asset Management México S.A. de C.V., a variable capital entity in Mexico.

2023

In July, Tenpo launched the first 100% digitally-based credit card in the Chilean market. In December, Credicorp published its first report to be fully aligned with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD).